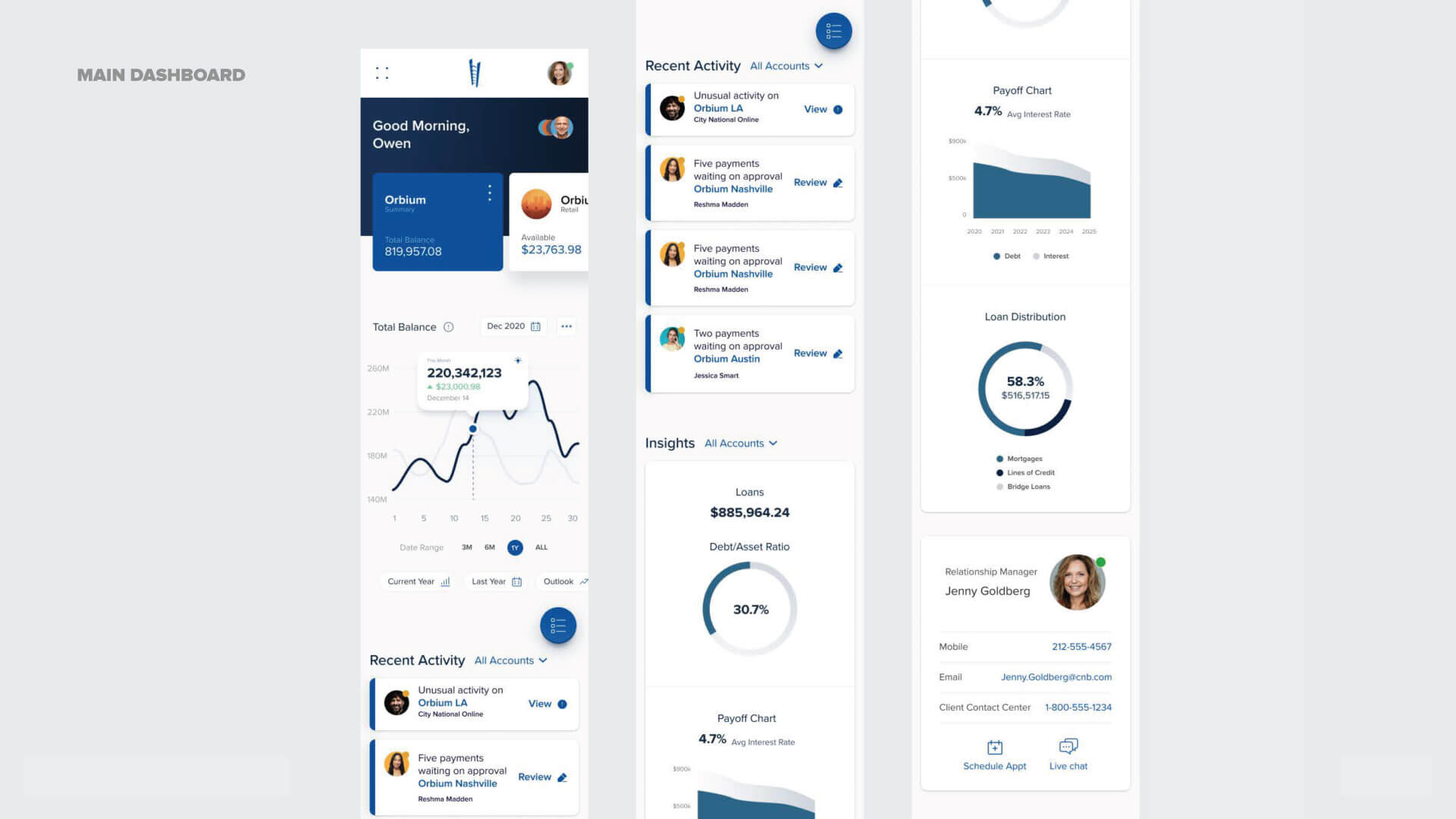

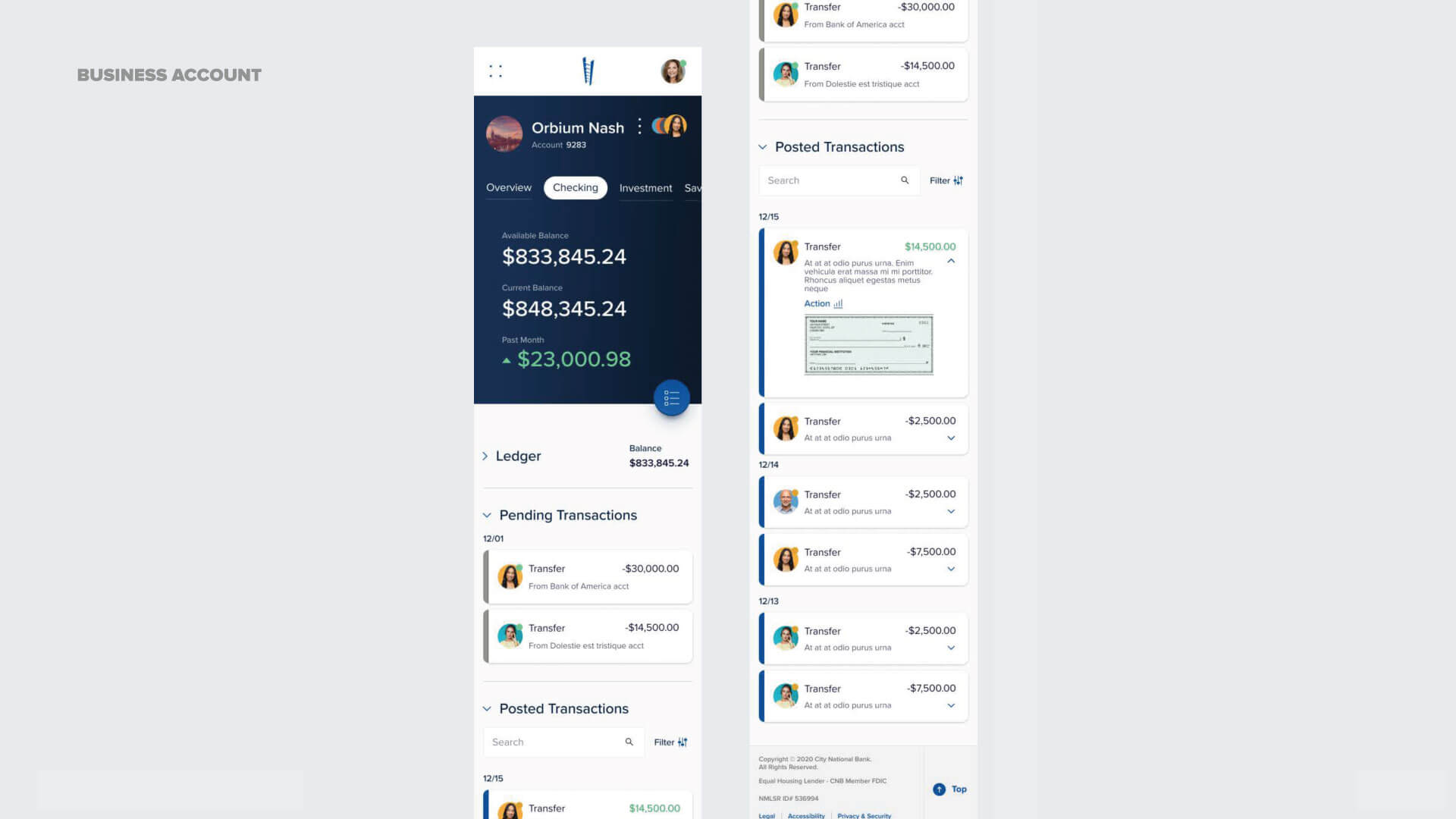

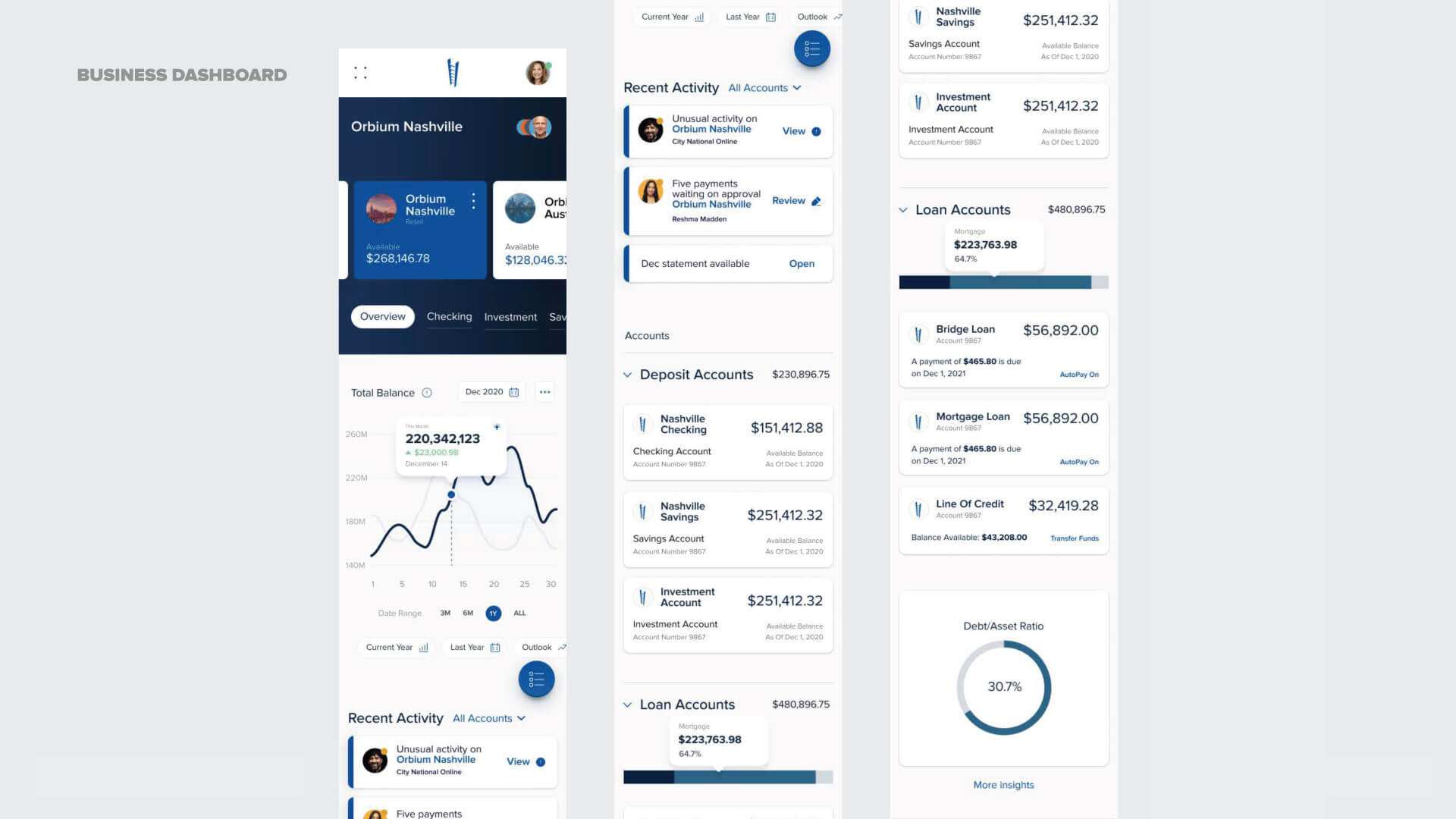

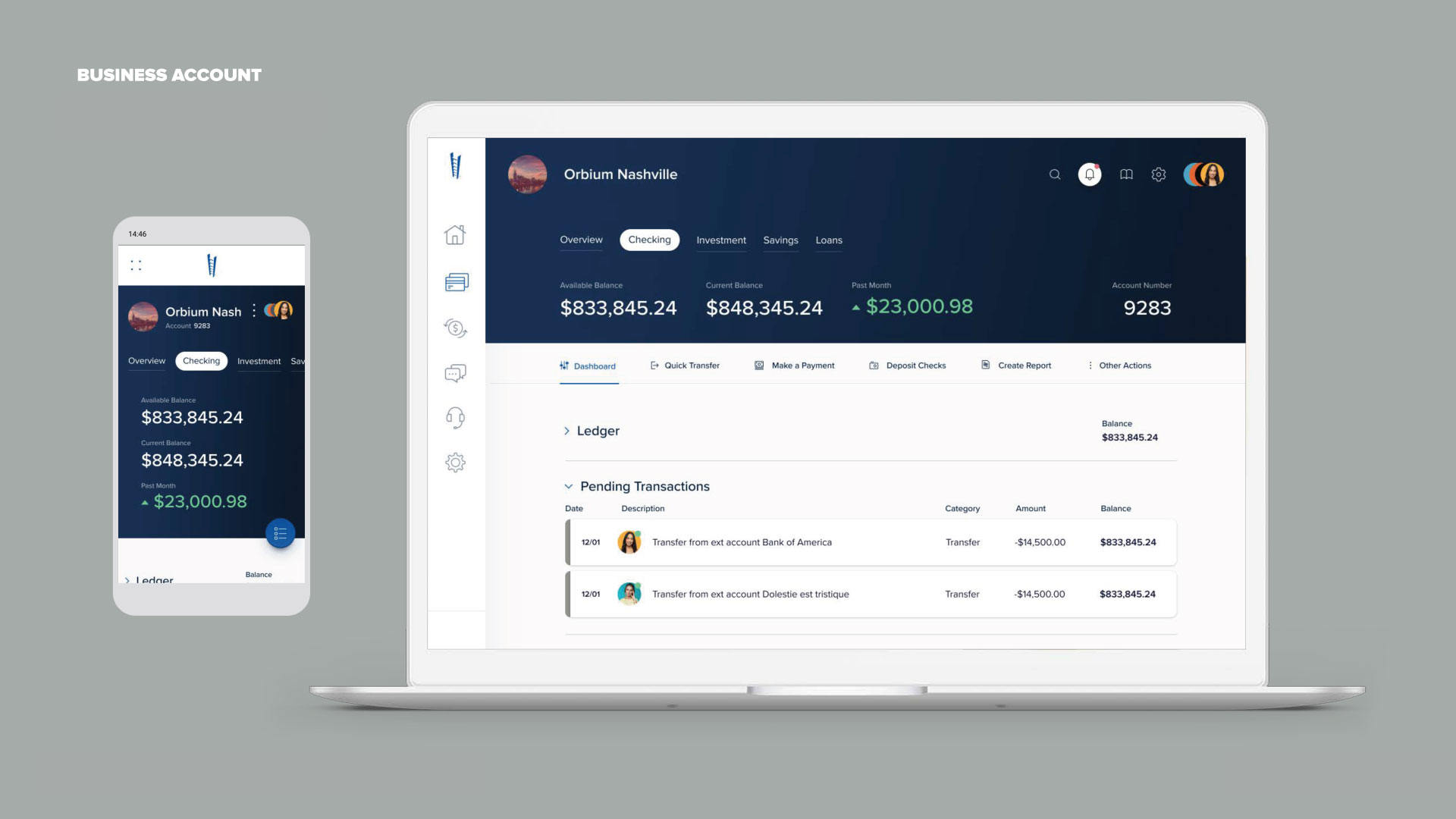

City National Bank’s business online banking customers have managed their accounts through the app or responsive portal. We found this way-of-working was lacking feedback mechanisms and details.

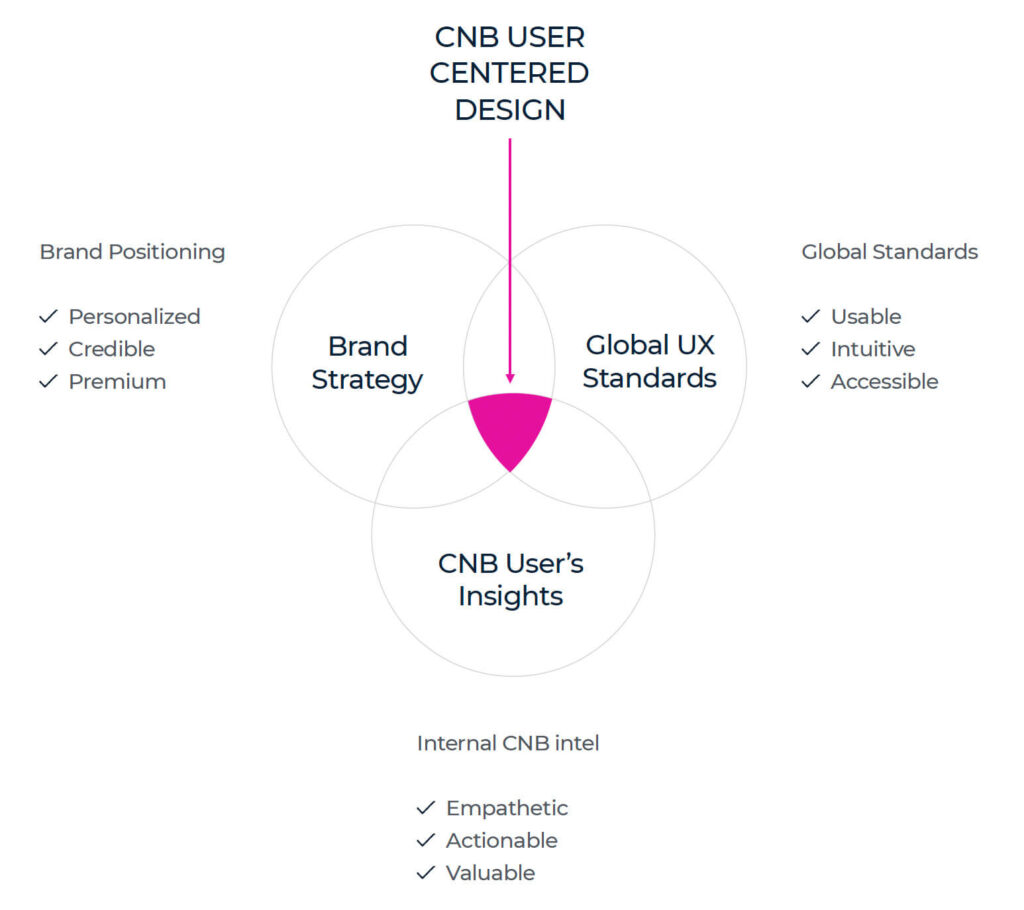

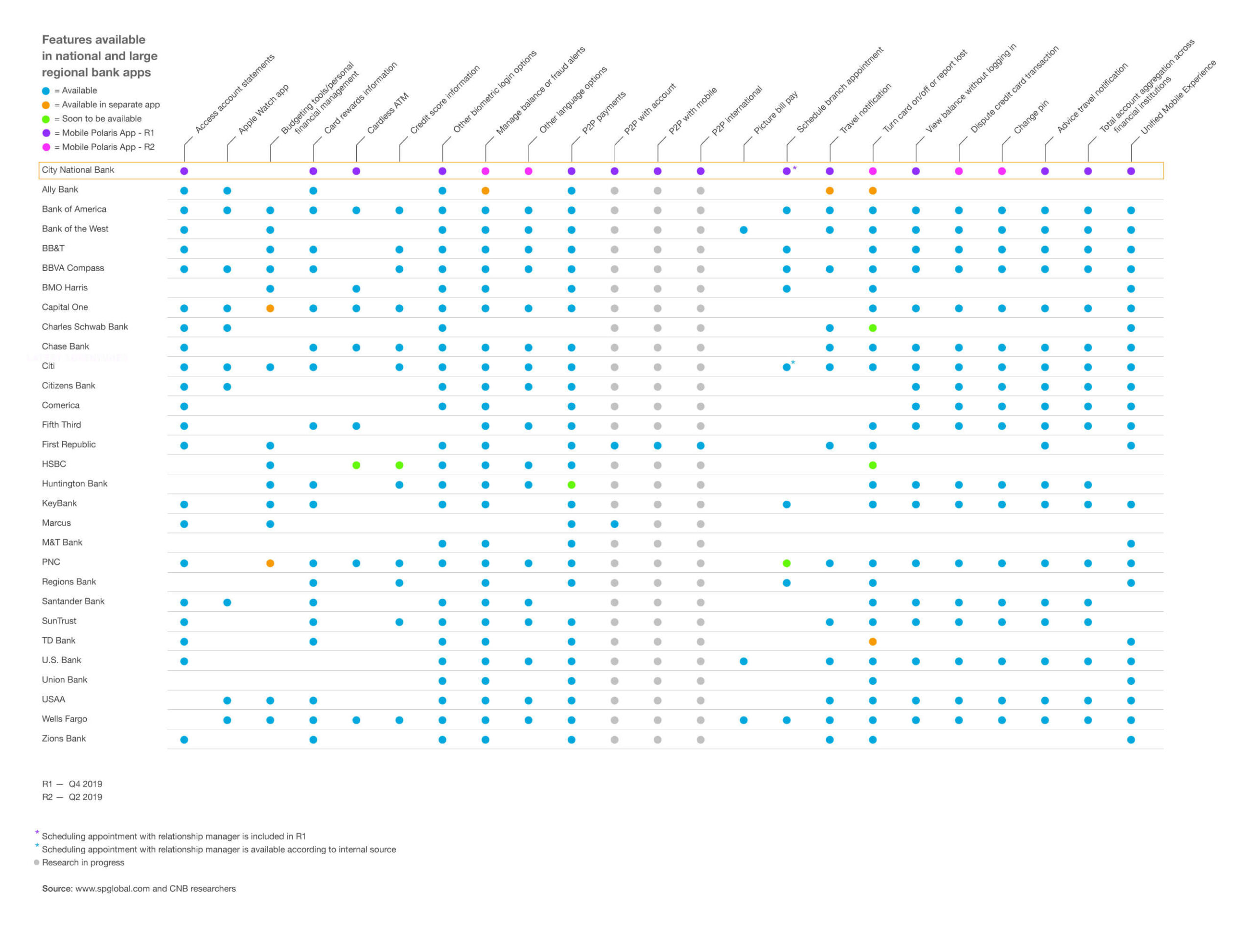

City National Bank provides a premium, personalized experience for clients. But the business banking experience does not reflect the same point of differentiation.

THE PROBLEM

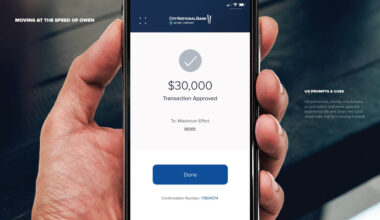

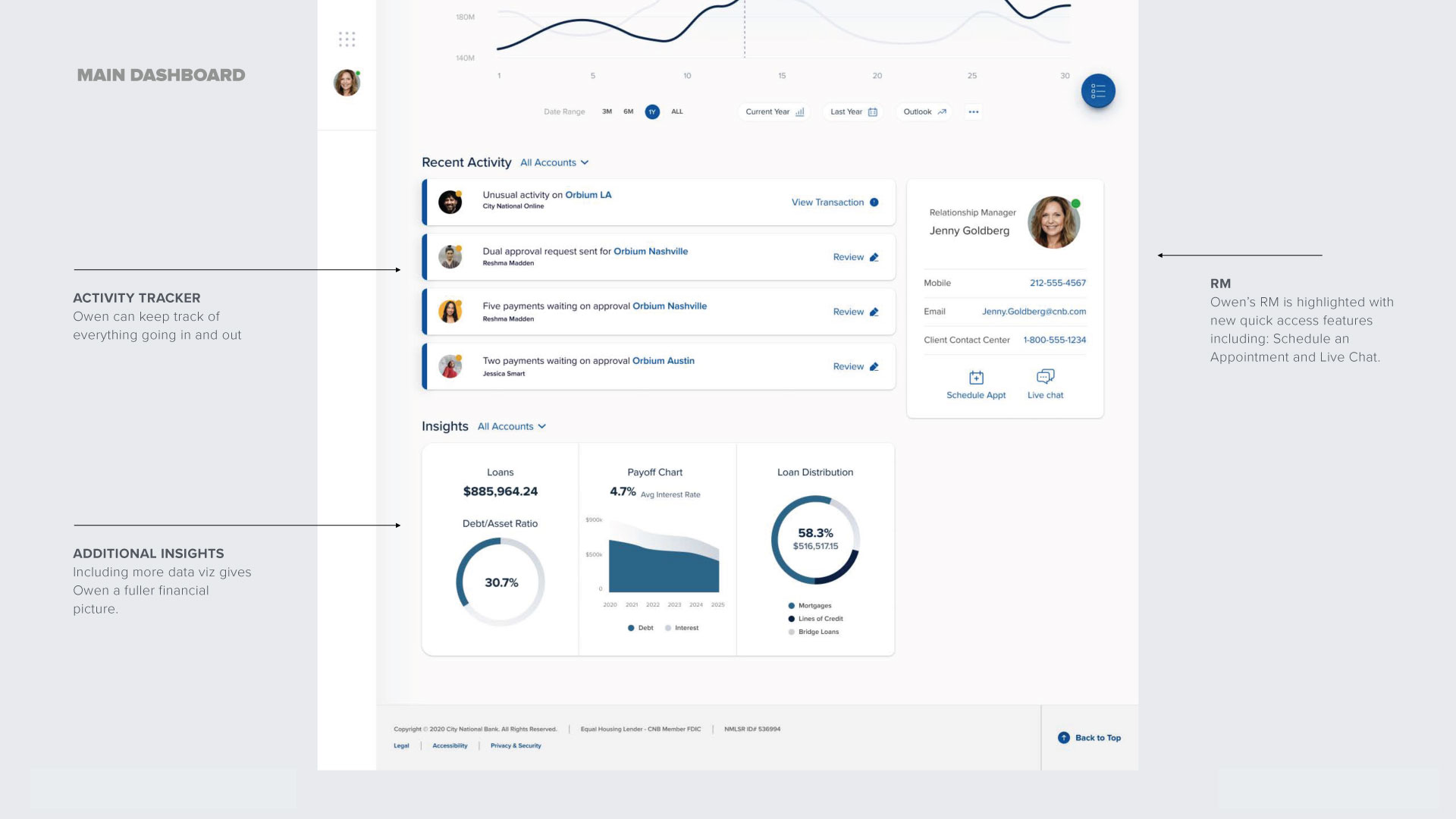

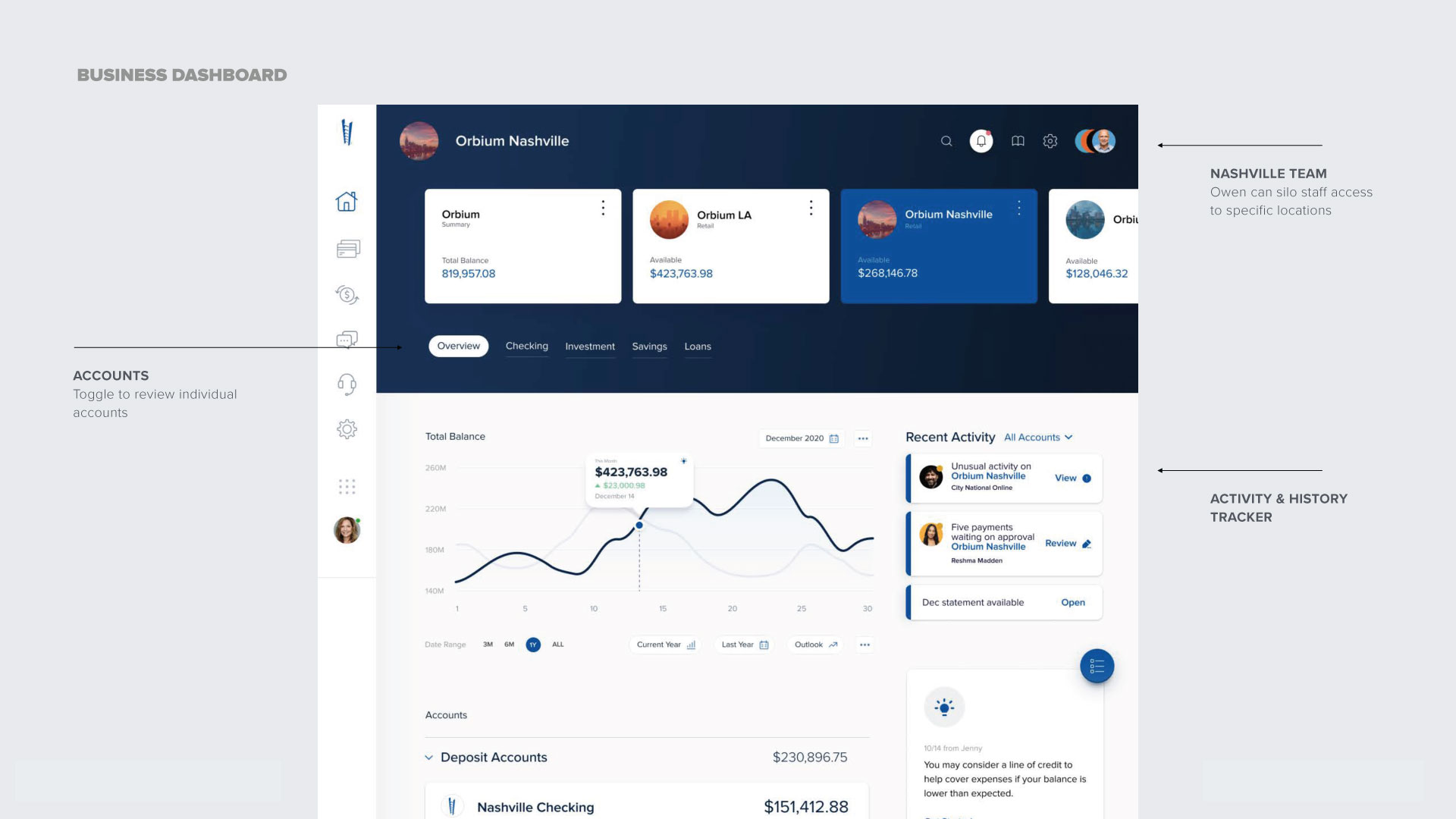

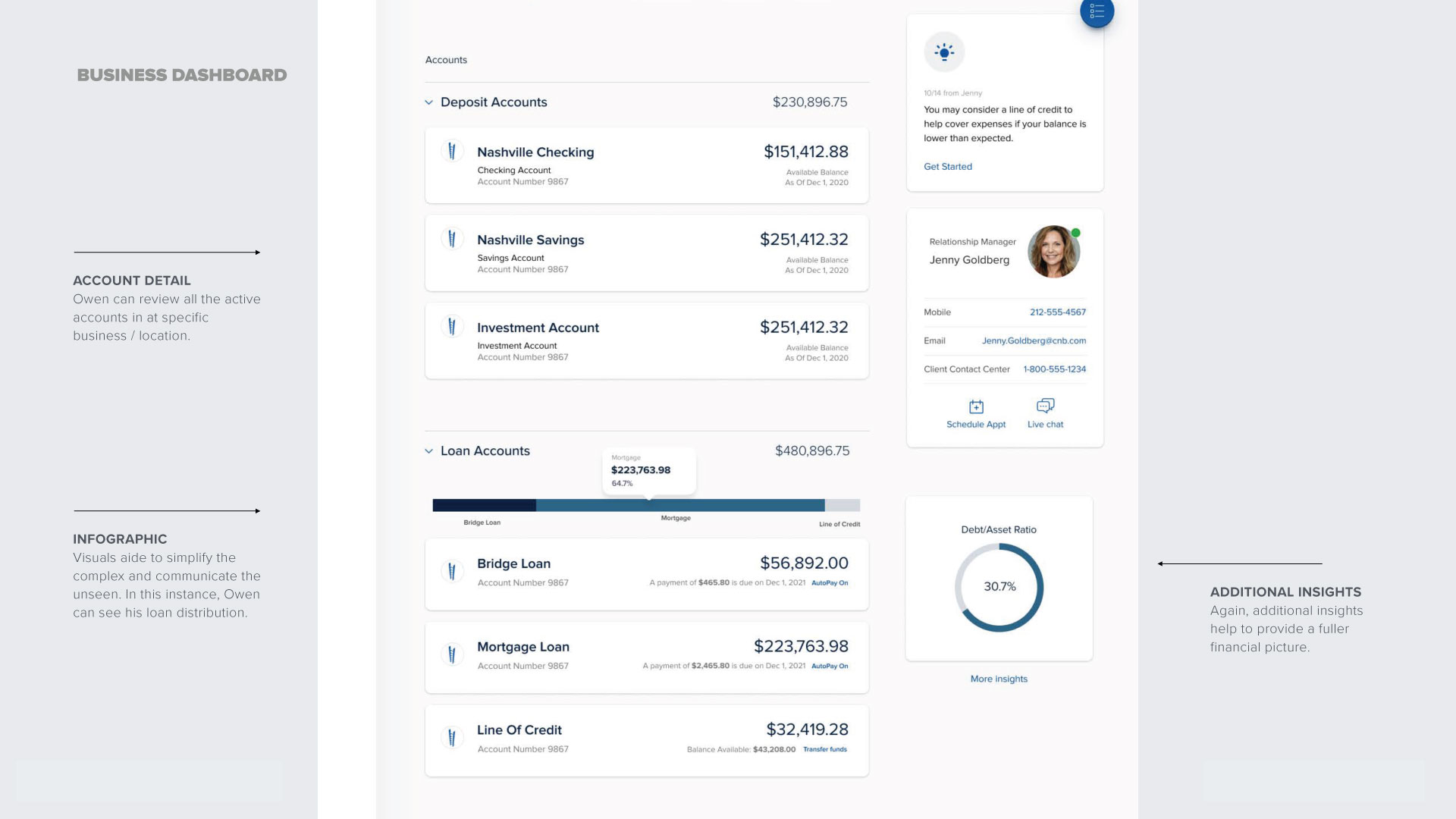

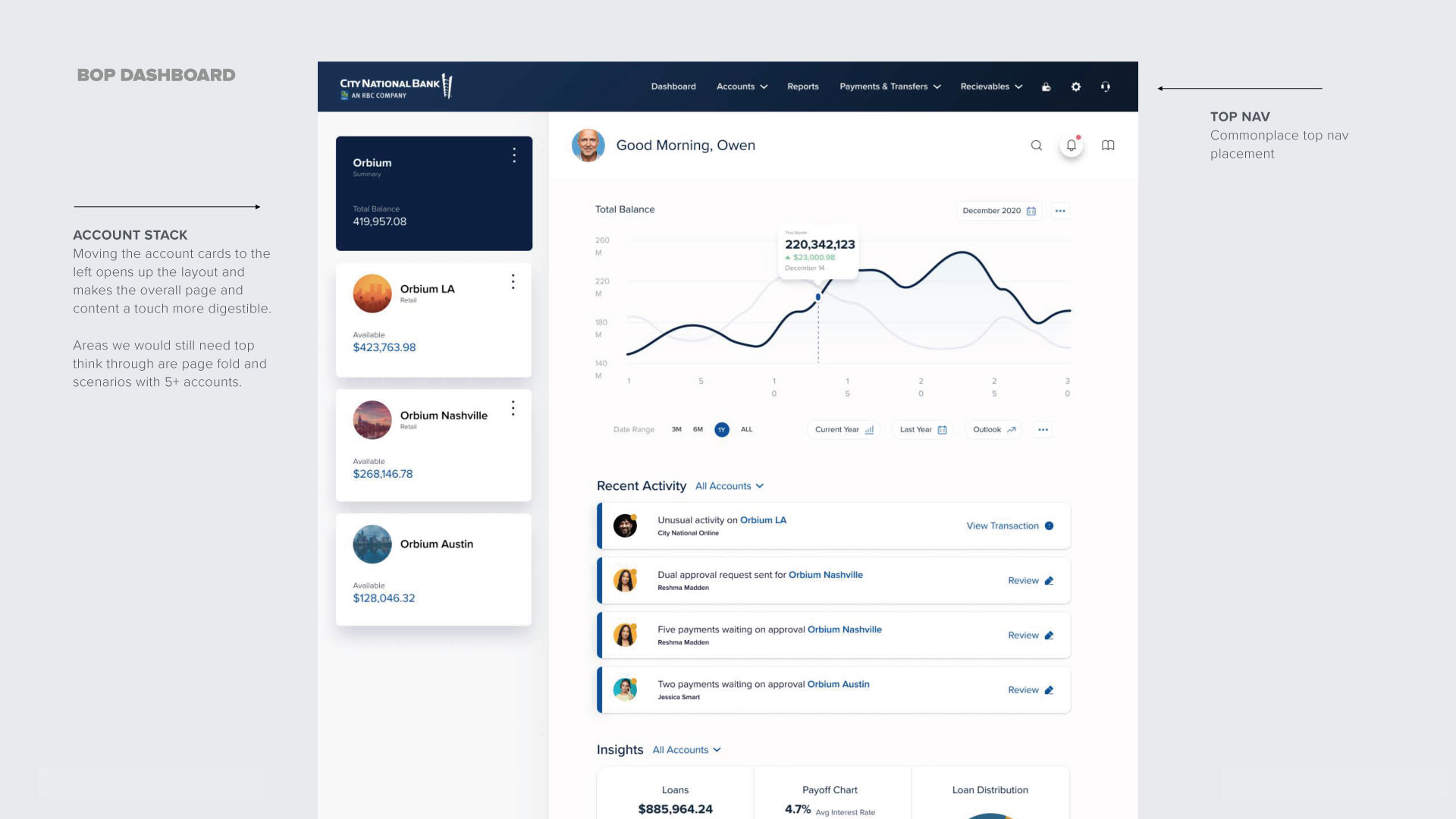

- The old experience simply displayed account standing and the money within it. There wasn’t anything actionable insights into user’s accounts and nothing was personalized.

- Feedback we received on the original business banking portal has shown that customers find the current experience difficult to navigate, with specific tasks that are multistep and time-intensive.

GOALS

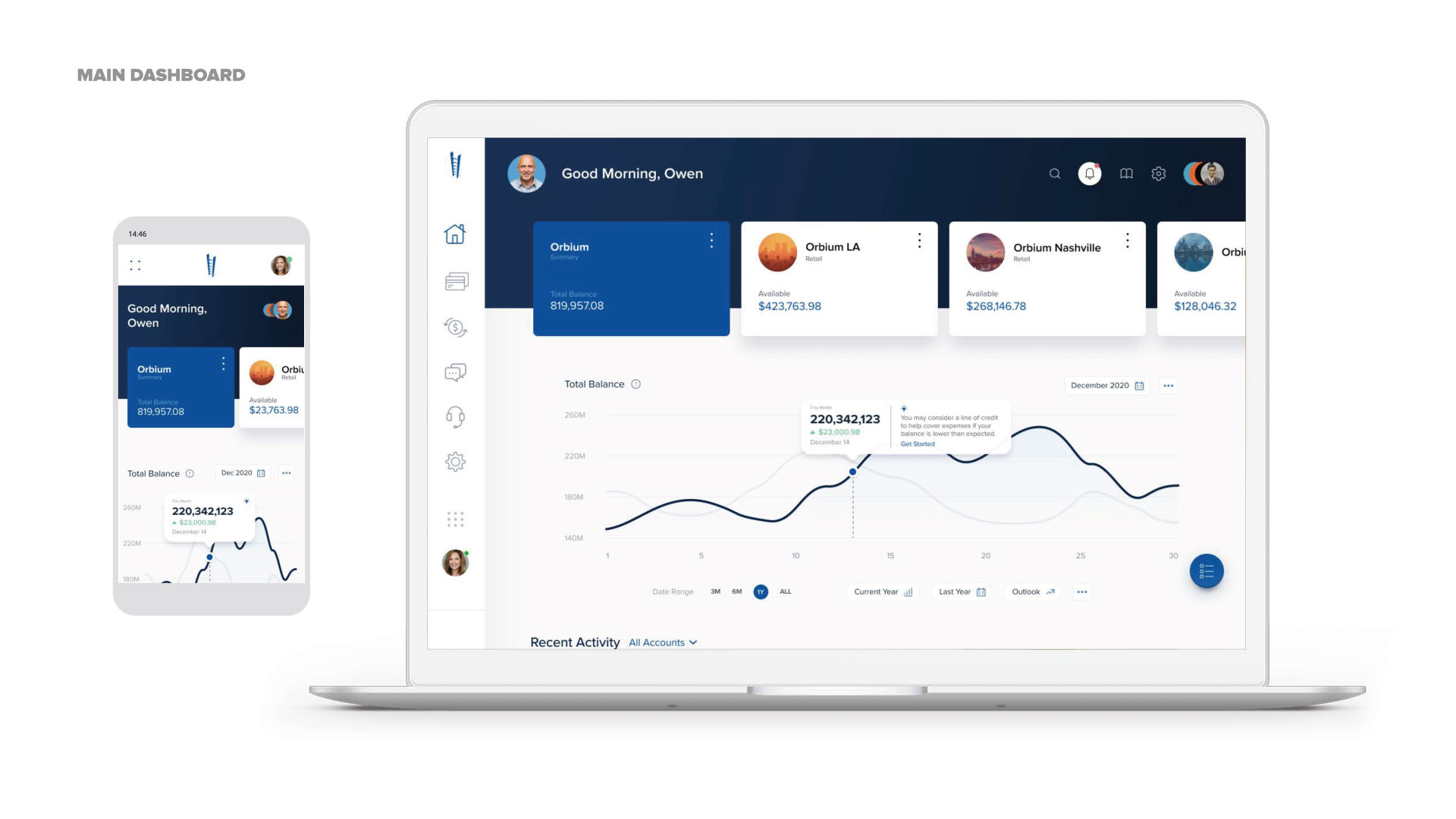

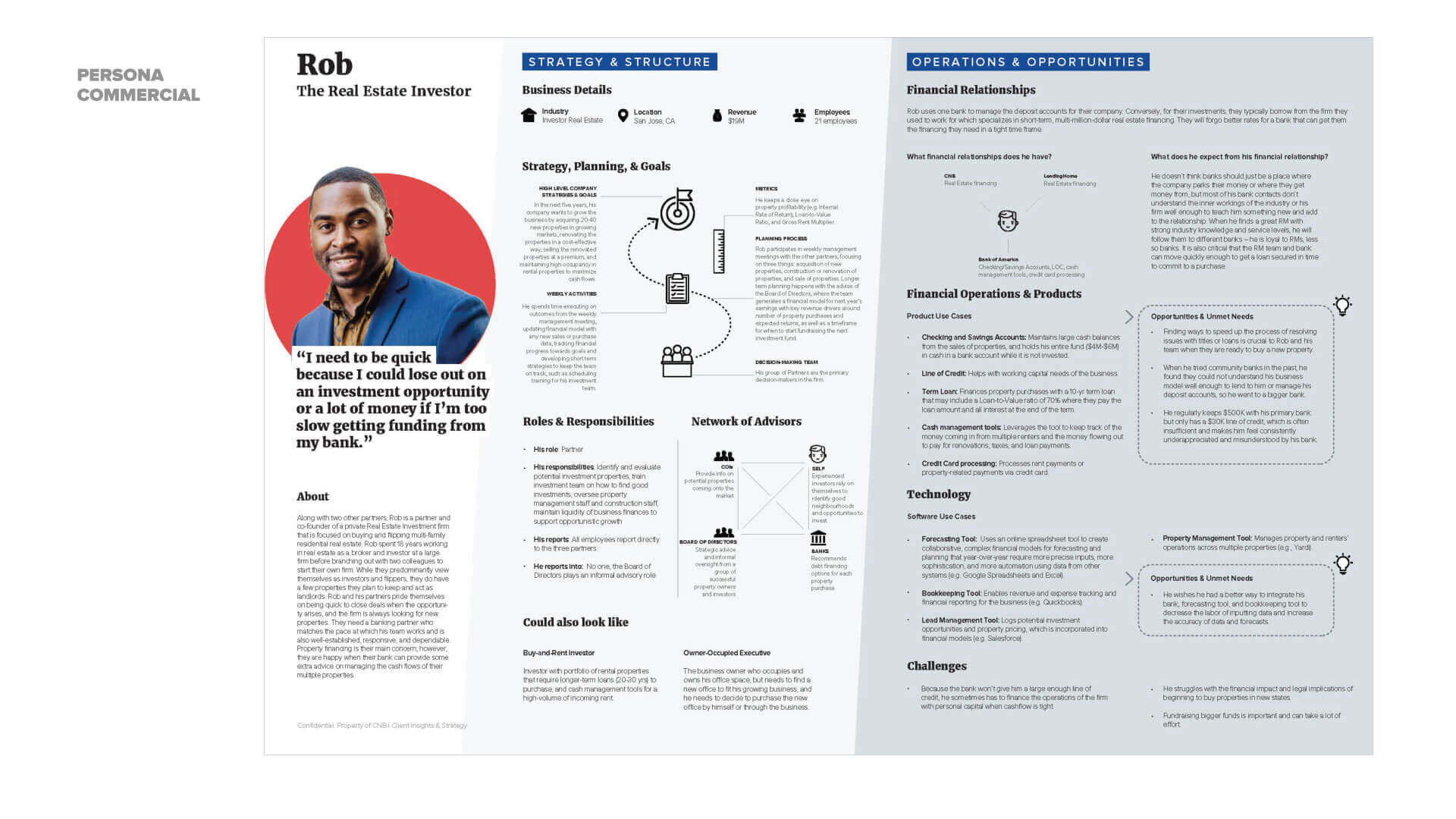

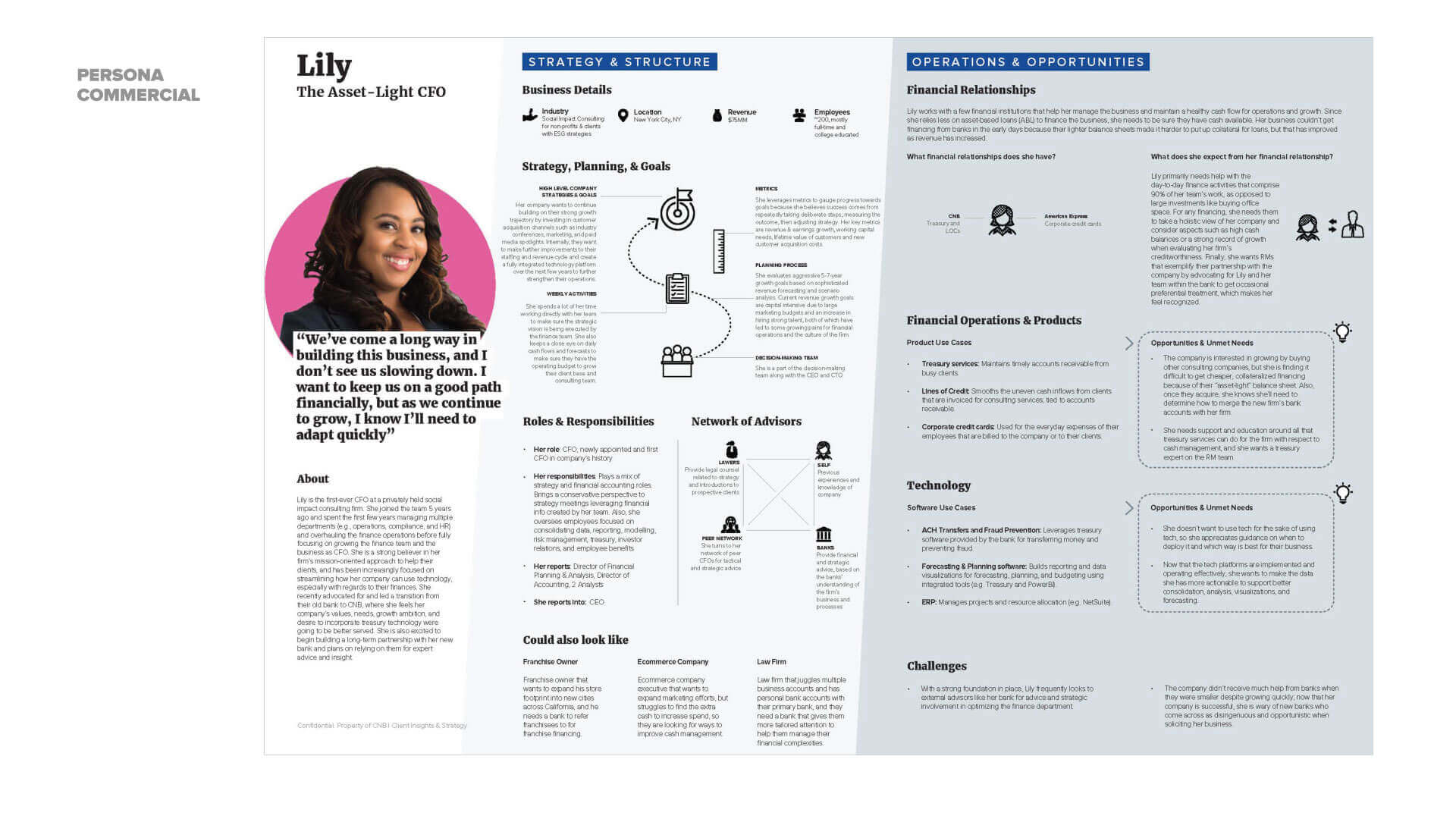

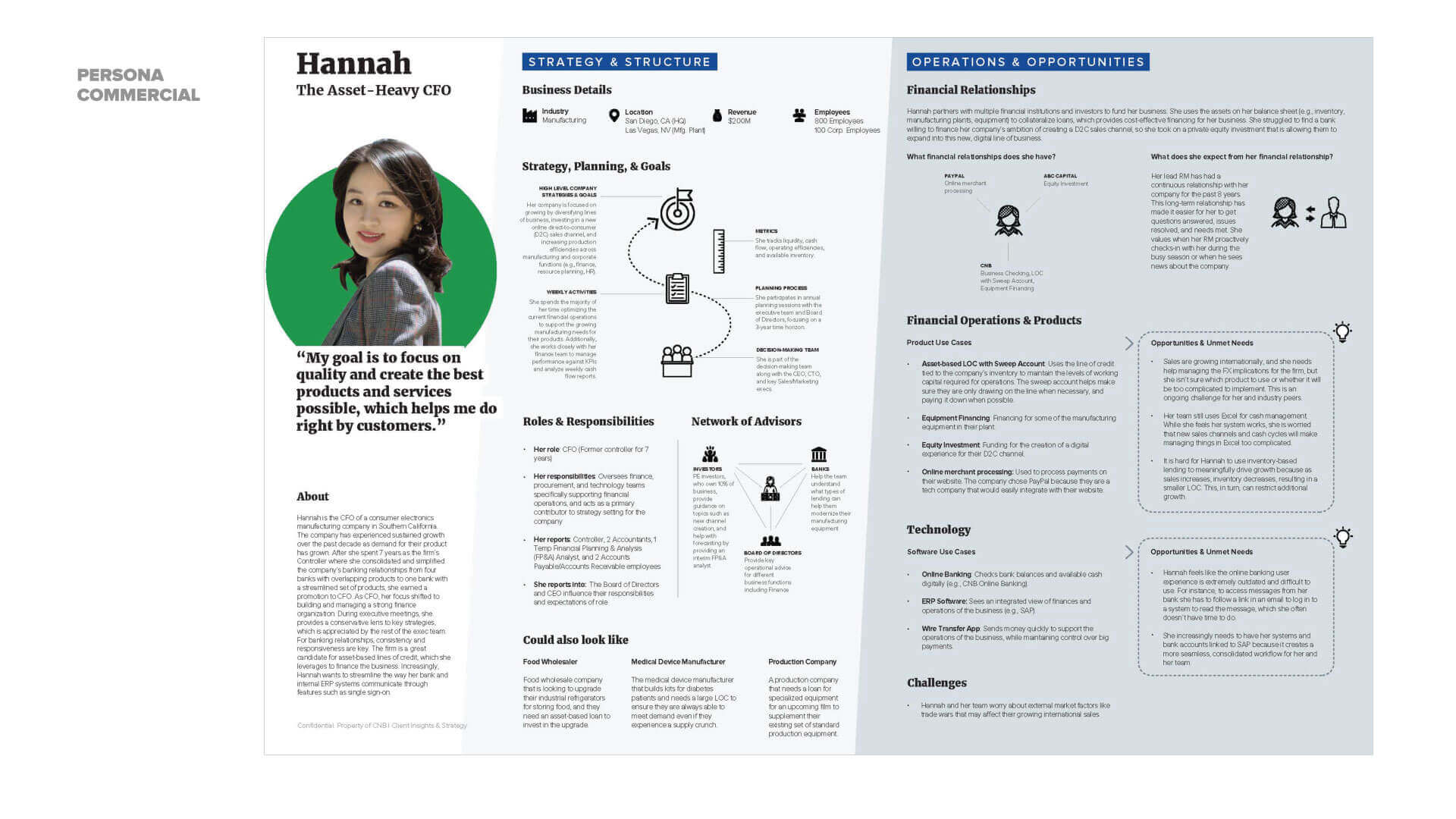

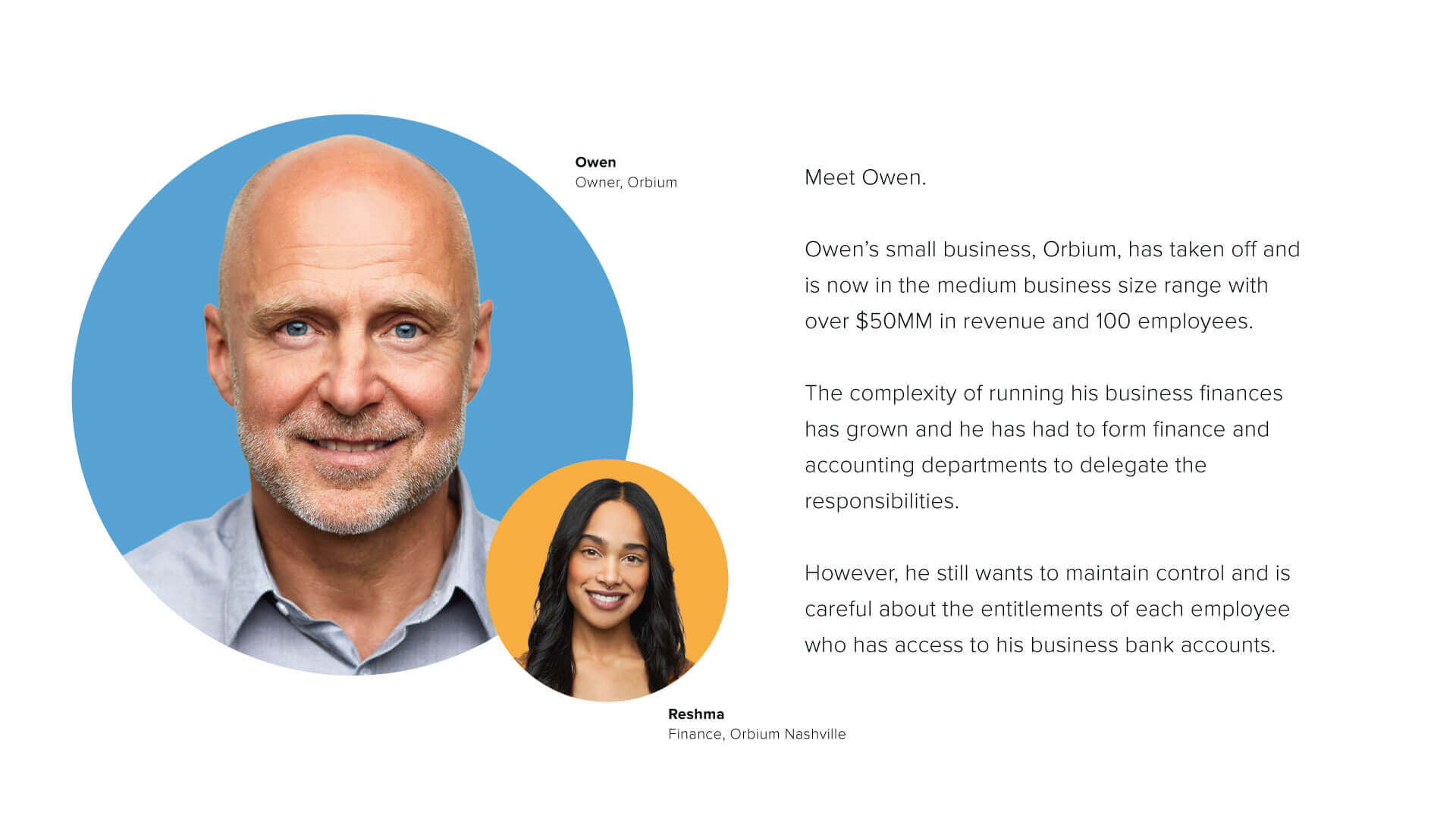

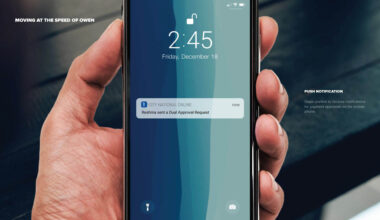

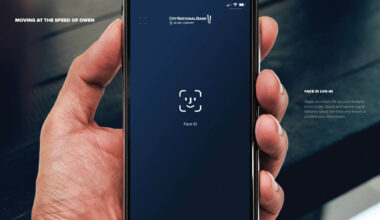

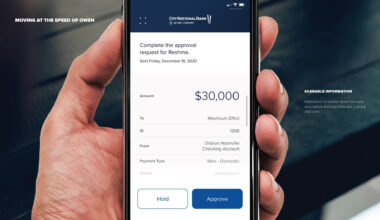

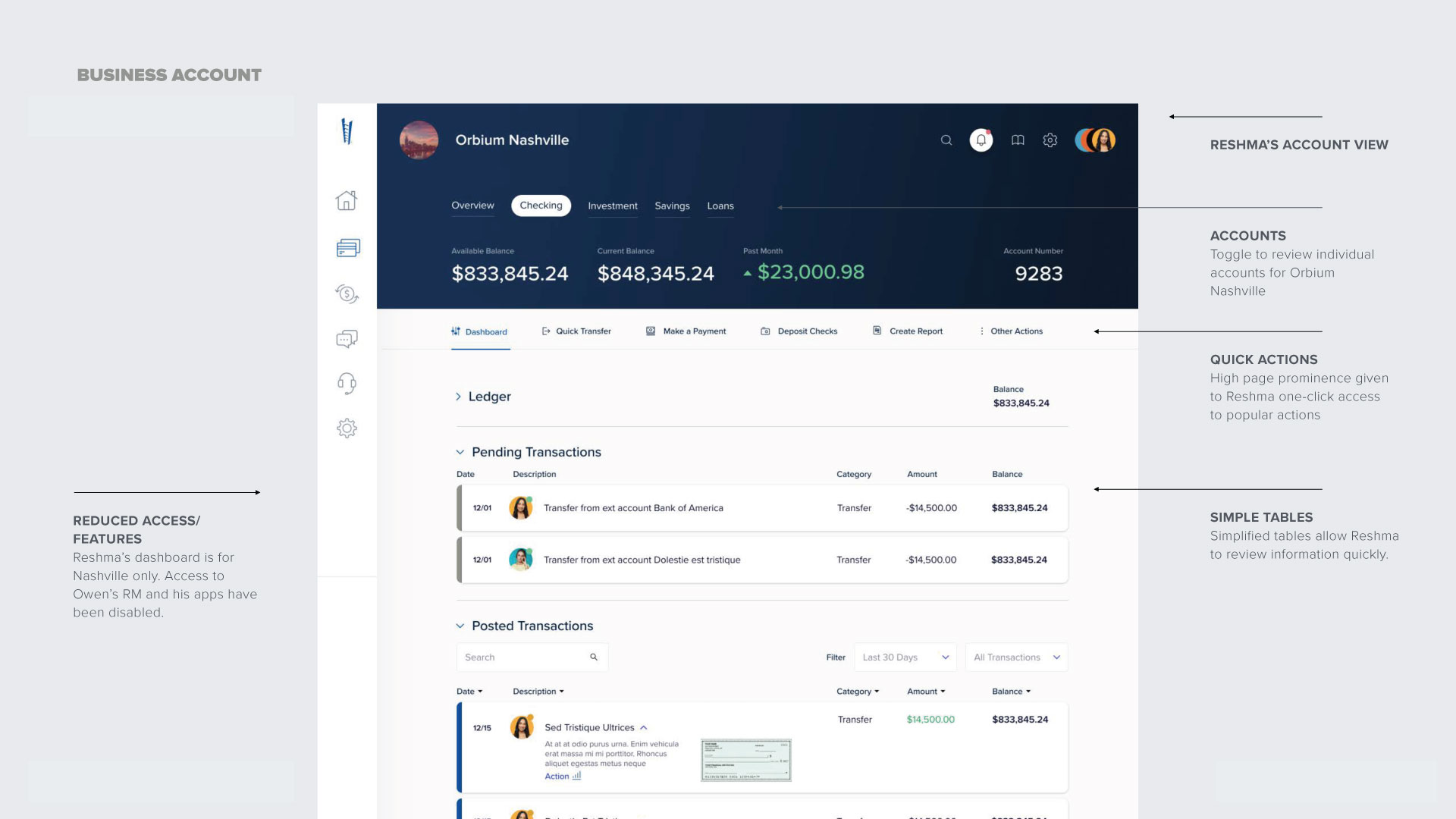

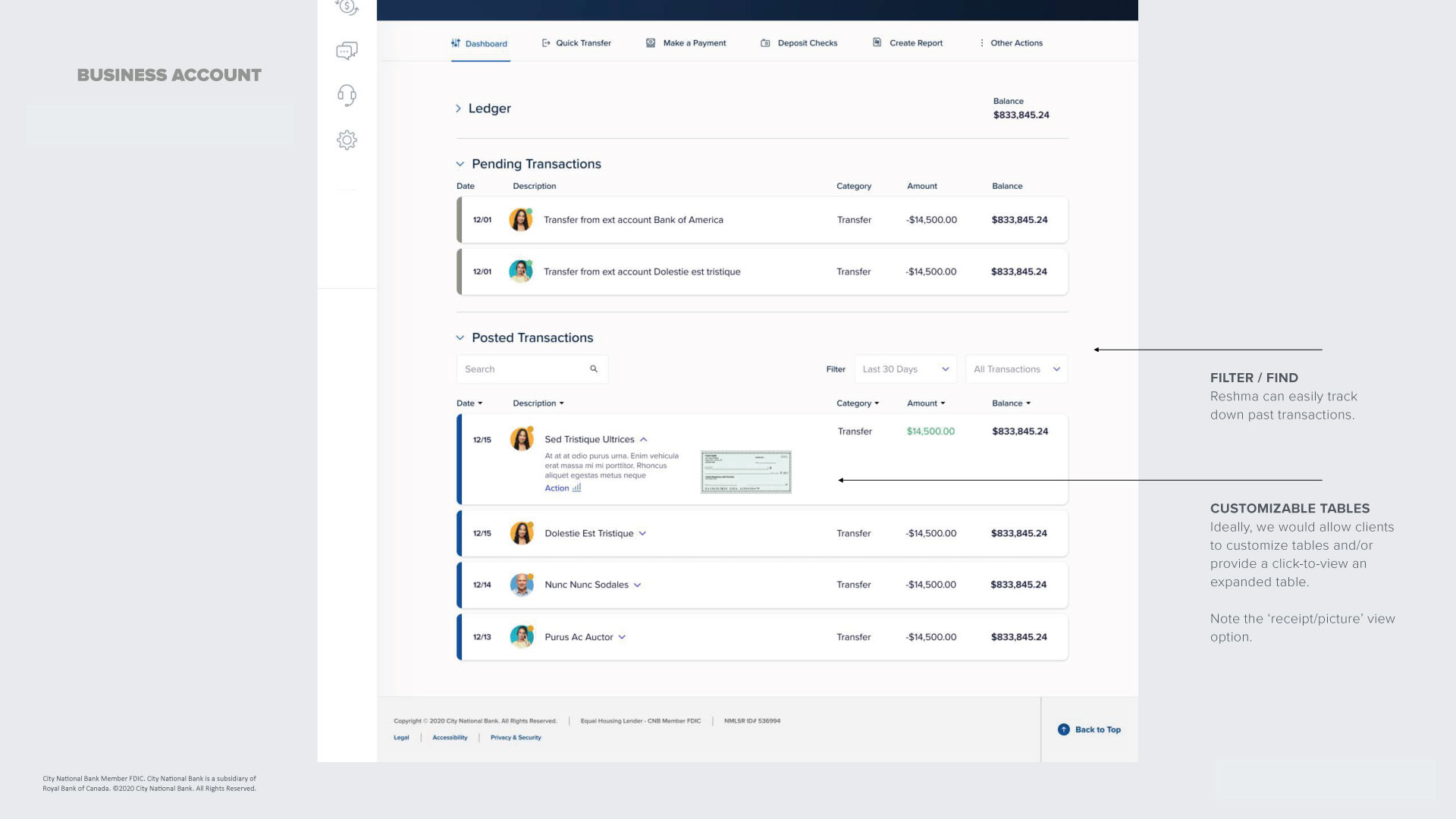

- Our goal for the project was to make a seamless, end-to-end business banking solution where the users can manage their finances, multiple accounts, and have levels of access for their employees.

MY ROLE

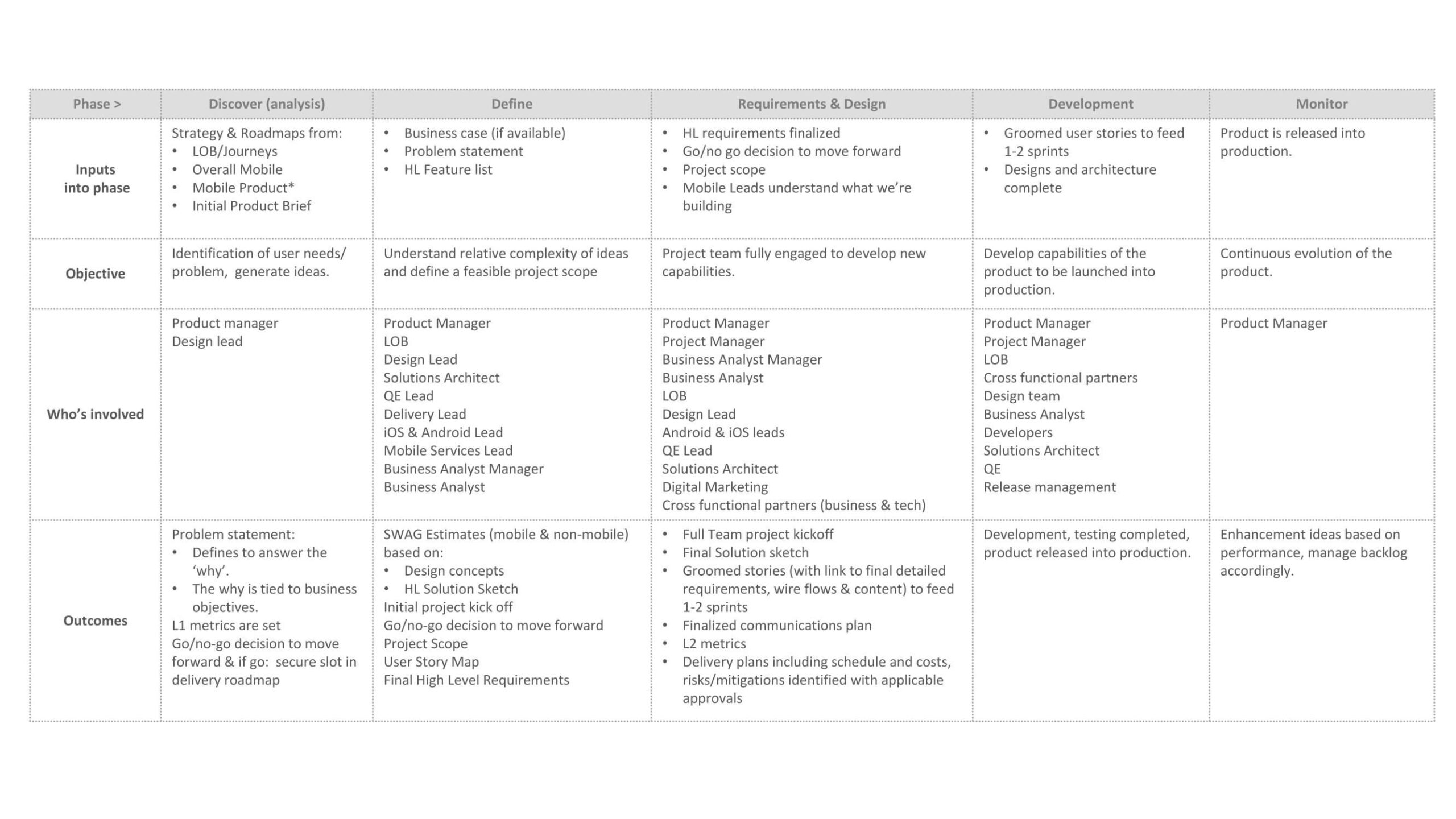

- Principle UX designer, product leader, sprint facilitator, and design thinker.